| Pt | Sa | Çar | Per | Cu | Ct | Pa |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 |

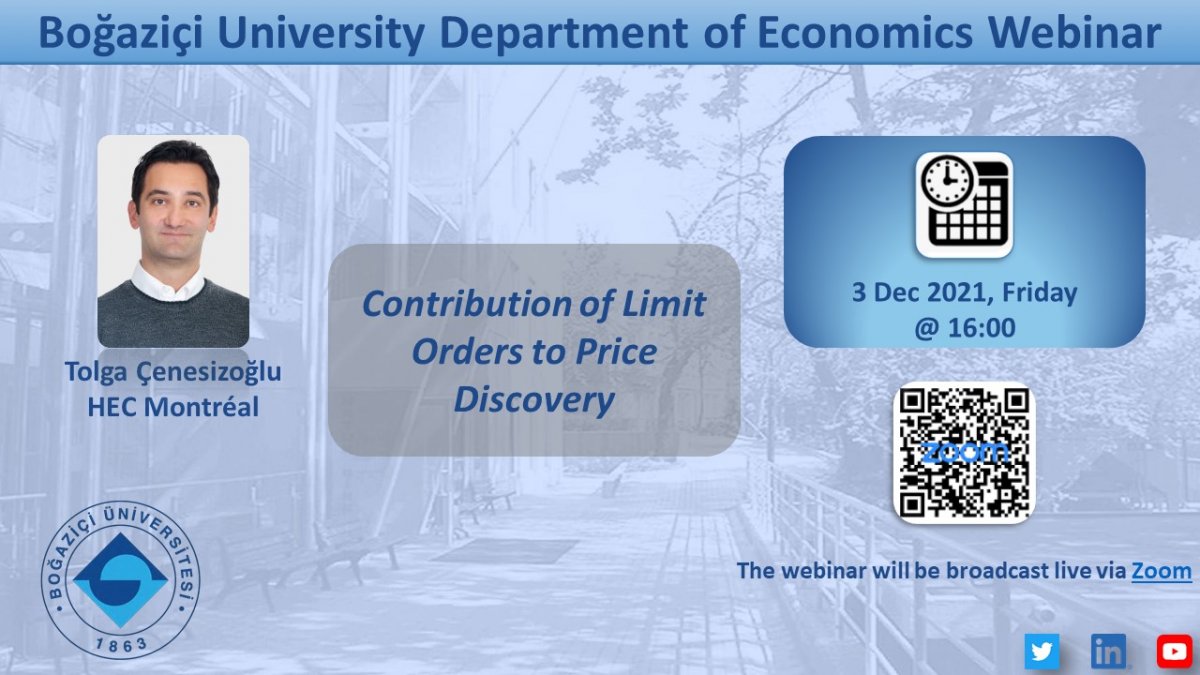

Contribution of Limit Orders to Price Discovery

You are invited to "Contribution of Limit Orders to Price Discovery" webinar by Tolga Çenesizoğlu (HEC Montréal). The webinar will be broadcast live via Zoom. Please click here to join the webinar.

Abstract:

In this paper, we analyze how and why limit orders contribute to price discovery. We do this by decomposing the total price change for a given stock on a given day into changes in the midquote in between trades and around trades. The change in the midquote in between trades is what we call the contribution of limit orders to price discovery while the change in midquote around the trades is the contribution of market orders to price discovery. We find that total daily return is the main determinant of limit orders' contribution to price discovery. We argue based on Foucault et al. (2005) and Rosu (2009) that informed market participants seem to be quite patient and use almost exclusively limit orders on good news days while they seem to be quite impatient and use market orders more aggressively on bad news days.